2024 Schedule A Deductions Allowed – You were generally allowed one exemption for yourself which is $185,000 in 2024 (it was $175,000 in 2023). Itemized deductions found on Schedule A have not changed. Here’s a refresher . Turbotax compiled the weirdest tax deductions allowed, from pet food to a trip It’s also a great place to schedule a tax write-off. Business conventions held in Bermuda are deductible without .

2024 Schedule A Deductions Allowed

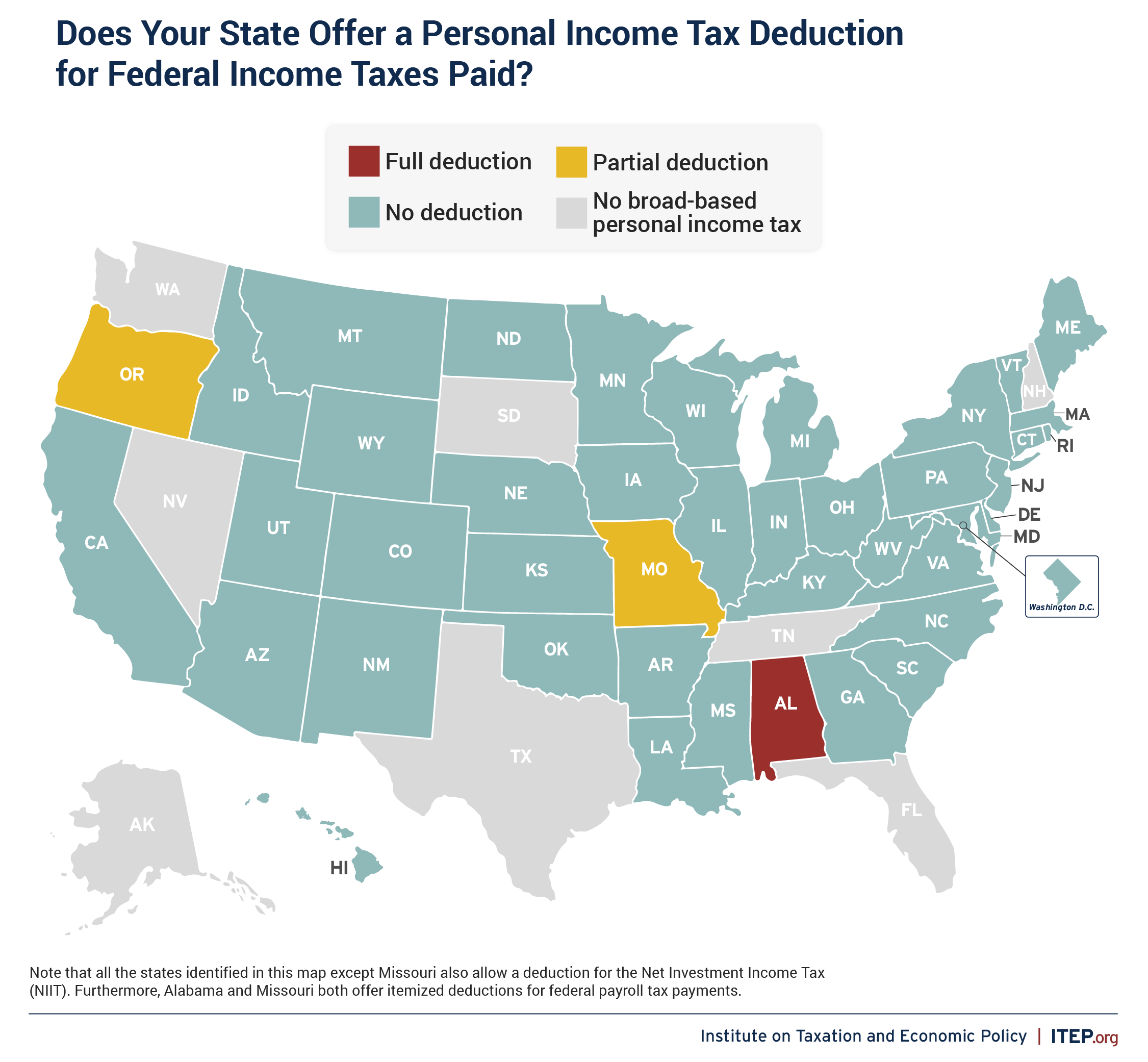

Source : itep.orgIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comFederal Tax Filing Deadlines for 2024 420 CPA

Source : 420cpa.comKeystone CPA, Inc. | Fullerton CA

Source : www.facebook.com2024 Schedule A Deductions Allowed Which States Allow Deductions for Federal Income Taxes Paid? – ITEP: A copy of this form will also be sent to the IRS. In most cases, homeowners can report the amount on this form on line 8a of Schedule A (Form 1040). However, the allowable deduction amount may differ . Unreimbursed business expenses are an itemized schedule A tax deduction that can reduce your tax liability. The IRS only allows you to deduct business expenses not reimbursed by your employer. .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)